ITS launches its own stocks indexes — ITS World Index and ITS Shariah Index

The international trading platform ITS started publishing the values of its own first stock indexes — the ITS World Index and the ITS Shariah Index – at 11:00 Astana time (05:00 GMT) on Aug. 10, 2023.

The ITS World Index (ticker: ITSW) is ITS's primary index. It comprises stocks of the 50 largest companies from the United States, Europe, and Asia, including Kazakhstan. The modeled historical performance of the Index for the back-test period from May 7, 2020, to August 9, 2023, stood at 64.85%, surpassing the actual returns for the same period of the Hong Kong Hang Seng index (-20.83%) and the S&P 500 (56.16%), but behind the Nasdaq-100 (65.65%).

During the back-test period, the ITS World Index showed one of the lowest volatility rates compared with global indexes like the Nasdaq-100, the S&P 500, and the Hang Seng, while maintaining a comparable level of performance.

Back-Test Results for ITS World Index

The top 30 stocks of the ITS World Index include major international companies:

- U.S. firms like Apple, Microsoft, Alphabet, Amazon, Berkshire Hathaway, Tesla, Meta and NVIDIA;

- European companies like AstraZeneca, Shell, Novartis, SAP;

- Asian firms such as Alibaba Group, Toyota, Sony, JD.com;

- Kazakhstani companies like Kaspi.kz and KazMunayGas.

The ITS World Index is well-diversified: the top 10 securities constitute 30% of the Index's structure, the top 20 securities make up 50%, and the concentration limit per issuer is capped at 10%.

ITS will review the calculation base of the ITS World Index and conduct its rebalancing once every three months (on Nov. 4, Feb. 4, May 4, Aug. 4). Index values will be updated in real-time mode from 11:00 to 03:00 on the following day in Astana time — during ITS trading hours (05:00-21:00 GMT). An essential condition for a security's inclusion in the Index is its high liquidity, which ensures the replicability of the Index.

The ITS Shariah Index (ticker: ITSS) was created in collaboration with the independent Shariah expert company, Sahih Invest. The Index comprises stocks of the 30 largest companies that adhere to Shariah requirements and are traded on ITS. The methodology for analyzing companies has been developed in accordance with AAOIFI and DFM standards and is accredited by the Council of Ulema of the Spiritual Administration of Muslims of the Republic of Tatarstan (Russia).

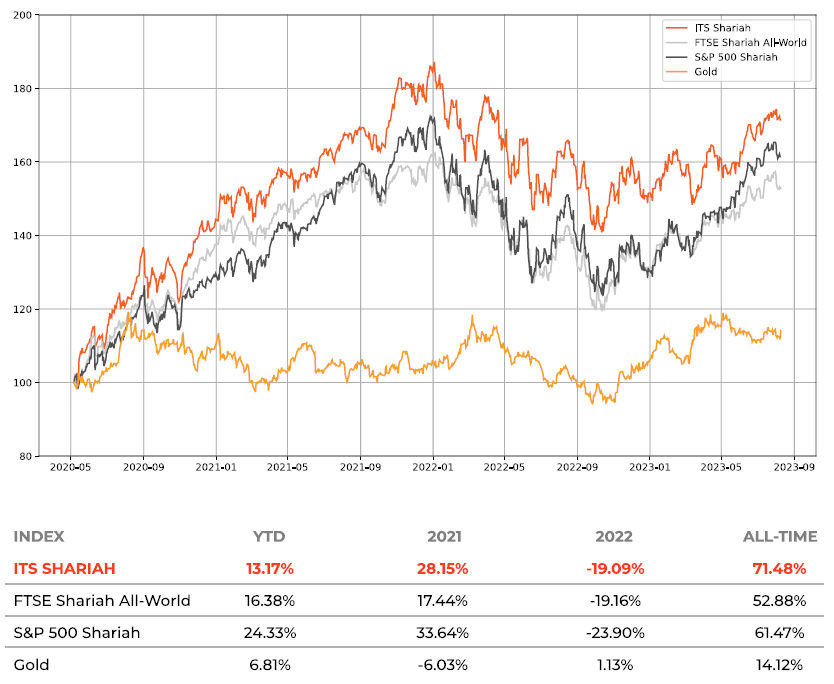

During the back-test period, from May 7, 2020, to August 9, 2023, the ITS Shariah Index showed dynamics similar to major global Shariah indexes, while significantly outperforming gold.

Back-Test Results for ITS Shariah Index

The top 10 constituents of the ITS Shariah Index include securities of major international companies such as Tesla, Visa, Exxon Mobil, Amazon, Johnson & Johnson, The Procter & Gamble, Chevron, Merck & Co, Adobe, Cisco and Salesforce.

The ITS Shariah Index is well-diversified in terms of both industry representation and the concentration of the largest international companies within it: the top 10 securities constitute 40% of the Index's structure, the top 20 securities make up 60%, and the concentration limit per issuer is capped at 10%.

ITS will review the calculation base of the ITS Shariah Index and conduct its rebalancing on the fourth day of every month. Index values will be updated in real-time mode from 11:00 to 03:00 on the following day in Astana time — during ITS trading hours.

The ITS World Index and the ITS Shariah Index adhere to the best global practices and meet the requirements of international institutions and regulators.

"The ITS indexes serve two purposes. Firstly, investors between the London and Hong Kong time zones, from 11:00 AM to 3:00 AM the next day in Astana time, receive a high-quality indicator of the global market situation in real-time,” said Alexander Diakovsky, Managing Director of ITS. "Secondly, in collaboration with the financial market participants of the Republic of Kazakhstan and with the support of the AIFC (The Astana International Financial Centre), ITS has already begun working on creating exchange-traded funds (ETFs) based on its indexes. Once they are introduced to the market, any investor will have the opportunity to purchase a portfolio of stocks from all global companies included in the index. This will be more cost-effective, liquid, and accessible than anything available in the region today. Therefore, we are confident that the launch of ITS indexes should be an important step towards establishing a centre for the modern exchange-traded funds (ETF) industry for the entire Central Asia region within the AIFC."

About ITS

ITS is an international liquidity hub, which gives investors from Kazakhstan and other countries access to 1,666 traded securities.

ITS provides deep liquidity for traded securities thanks to its business model based on the principles of best execution and smart order routing technology, enabling investors to execute securities transactions at the best prices of the global financial market and in any volume.

ITS offers a long trading session of 16 hours a day, five days a week, from 11:00 to 03:00 of the following day in Astana time, covering the operating hours of leading Asian, European, and American stock exchanges.

ITS press-service

pr@itsx.kz